In today’s fiercely competitive world, customer experience (CX) is often the main differentiator for banks. When it comes to choosing which financial institution to bank with, customers look at the quality of customer experience. In fact, it’s the key deciding factor.

That includes fast and efficient services, especially personalized experiences. Customers want banks to understand them as individuals with their own unique likes and tastes. And provide services based on these needs/preferences.

And while all banks don’t have the capabilities for this, FinTech companies definitely do.

FinTech is winning the CX game

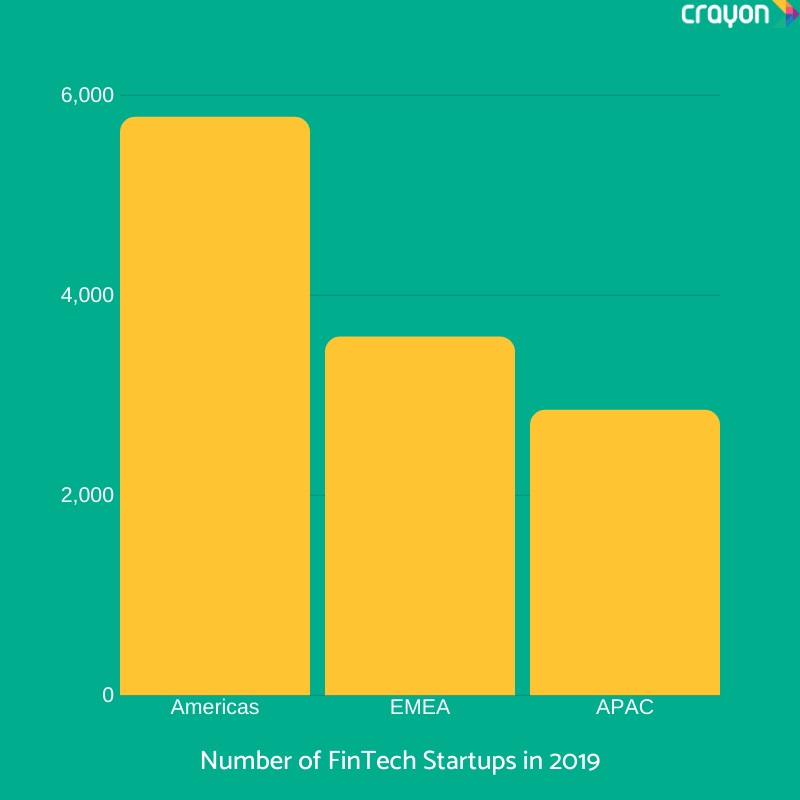

The number of FinTech companies around the world has risen considerably over the years.

And it shouldn’t be surprising. Especially considering the fact that 68% of customers are willing to use a FinTech product offered by a non-financial company.

In fact, a majority of those customers would also consider banking with a tech company like Amazon or Google, instead of their current bank.

This is mainly because such companies have triggered the desire for more personalized interactions among their customers. Moreover, these platforms have proved to be user-friendly, accessible and largely efficient.

The major advantage FinTech companies have, is ready access to the latest in digital innovation. What they don’t have is data. Banks, on the other hand, do.

This article was originally published on LinkedIn Pulse. You can read the full article here.